Yes, we had views to die for, great winter conditions, amazing summer hiking, a bigger apartment, our own car; all suddenly becoming a bit less significant now that we had discovered the infamous French bureaucracy…. and taxes!

We had arrived in France eight and a half months prior, finally gained our EU Carte de Sejour residency permits at the beginning of September (or at least the receipts for them), and thought life was golden. Little did we realise that things are never so simple. It took a good few months before I’d read somewhere that as long as you’re spending 183 days in France you have to file a French tax return – not really a big deal as filing doesn’t necessarily mean anything, right? We just thought… it’s not due until May 2021 so we have loads of time! We also knew that we would have to make another application for Carte de Sejours once the French Brexit website opened to make the switch to non-EU residence permits – this apparently would just be a formality where I was guaranteed the permit due to my current UK citizenship and Andrea would have no problems being my spouse. Okay, still nothing to worry about!

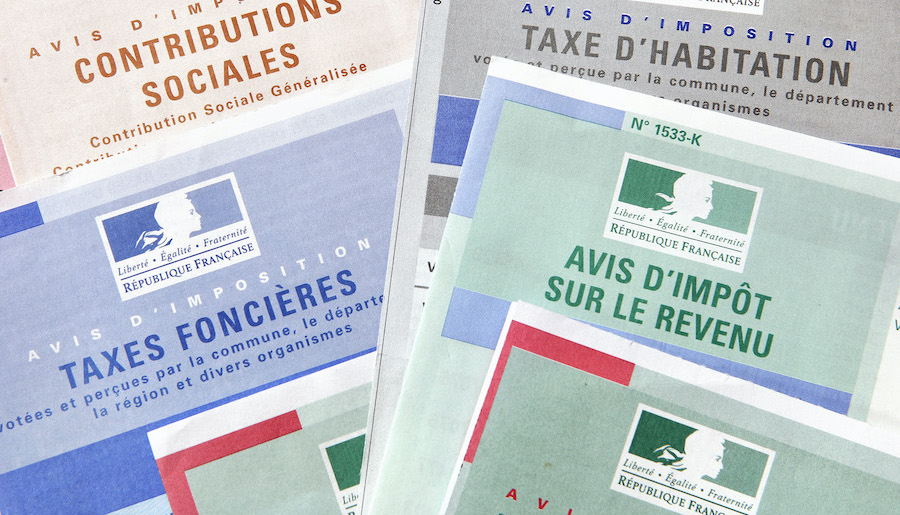

Right up there with the top tax and social charges in Europe!

… and then the more we Googled the bigger, and more complex, the hole became. There wasn’t even a thought in our heads that would have assumed that Andrea working ‘remotely’ in France would matter – why would it? It’s for an American company (her own in this case), paid in US Dollars, taxes and social security paid in the US, with the income spent predominantly in France. Now we find out that it doesn’t matter; as long as your ass is on a chair in France carrying out the work it’s then classed as French earned income, and taxed accordingly – this was bad news! At the same time we discover this we called our US brokerage to ask a couple of hypothetical tax residency questions and they decided that we’re more hassle than we’re worth – all our assets suddenly liquidated into cash. Here’s hoping they crash and burn like the Lehman Brothers!

Another problem hovering around is what to do with my Green Card, due to expire mid February 2021 – initially we thought it made sense to renew it for another 10 years, totally ignoring the fact that I spend almost all of my time outside of the US nowadays. This is eventually going to cause a problem as anything over half the year overseas can lead to an abandonment of the permanent resident status! Anyway, we coughed up the $540 renewal fee, the next step being the biometrics appointment back in the States. After careful consideration the new next step being… screw it, I don’t want US residency anymore, and I definitely don’t want the IRS having the cheek to tax me on all worldwide income when I don’t even live there! Other than being married to an American it was time to break free from a country I once called home, now nothing more than the laughing stock of the planet.

Countless ‘free’ intro calls to US/French tax specialists later and we’re still nowhere. We have bucket loads of information but no idea how to proceed – the US tax system is bad enough but France definitely seems to love its complexity much more. And then there’s the language barrier, where speaking English doesn’t get us very far with US tax jargon, never mind the France side of things.

IMAGES

I think that with trial and error both my photography and website design are getting progressively better so hopefully these newer, better quality images will inspire you to get out there and travel. Click HERE to see more and if you like the content then feel free to comment.